The Anatomy of Seed Deals in India: Insights and Evolution

published By Rahul Garg , Akul Jindal , April 8, 2024

The Indian startup ecosystem has come of age in the last two decades. What started as an adaptation of US consumer internet businesses for India in late 2000s, soon grew into a lifeforce of its own with rapid rise in India focused playbooks, consolidation of India’s leadership in software, public-private partnership in scaling financial rails & products, a rally towards make-in-India, and most recently, a race to the space. India has certainly benefited from a multitude of factors, both geo-political and social, but at the core of its success lies the Cambrian explosion of talent and capital chasing innovation. It has been particularly pivotal for the 0 to 1 journey of an entrepreneur which has historically been the most perilous.

In this article, we discuss the anatomy of seed deals in India in the last two years, compare it with the state of the union a decade ago and provide insights into the startup ecosystem.

[For the purpose of this article, we define seed deals as investment rounds in which start-ups raised a total capital of $0.5-5M. Such deals accounted for c40% of total fundraises of less than $5M in 2023.]

The gold rush has subsided, but the shovels remain aplenty

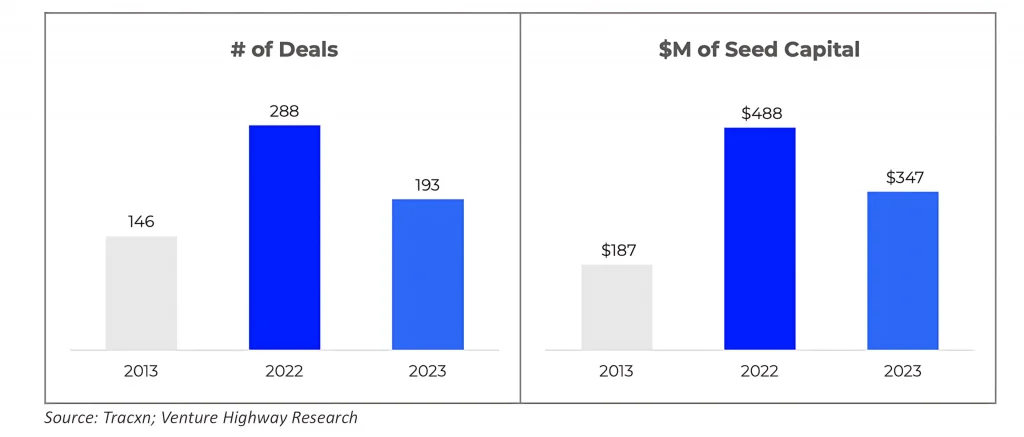

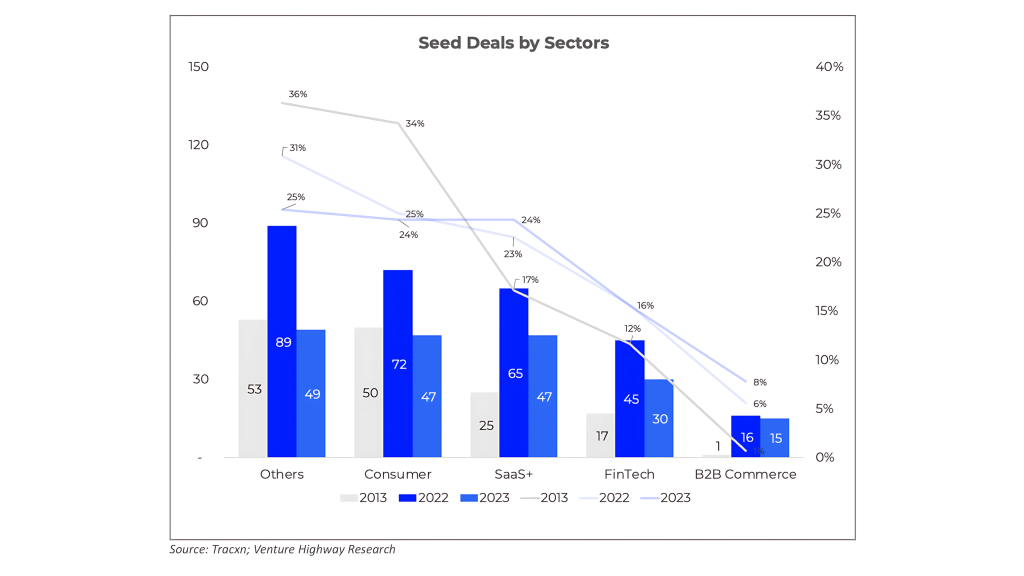

As expected, we saw significant correction in early stage investments in 2023, with seed deals reducing from a high of 288 investments in 2022 to 193 investments in 2023. The total value of investments declined from $488M in 2022 to $347M in 2023. This 33% decline in volume and 29% decline in investment value was largely driven by a raging interest rate cycle and the change of sentiment post the peak of liquidity in 2021.

However, even amidst the sharpest rate hikes in the last two decades, and a prolonged monetary tightening, coupled with geopolitical tensions across the globe, the deal activity remained strong when compared to the investment activity a decade ago. Compared to 146 seed investments raising a total of $187M in 2013, the early stage seed investments in 2023 stood at almost 2x in terms of capital deployed.

This underlines the fact that the Indian startup ecosystem has significantly expanded in the last decade across all the vectors of talent, breadth of innovation, and capital. A quick look at investors in seed deals show that when compared to 2013, the total number of lead investors have grown by c2.7x to 339 and the total number of participating investors have grown by c2.2x to 1230. A higher growth in investors that lead rounds vs. those that participate underscores significant expansion in smart capital chasing conviction across a broad range of end markets, thus deepening innovation in the country.

Figure 1: Total seed investments in 2022-23 vs. 2013

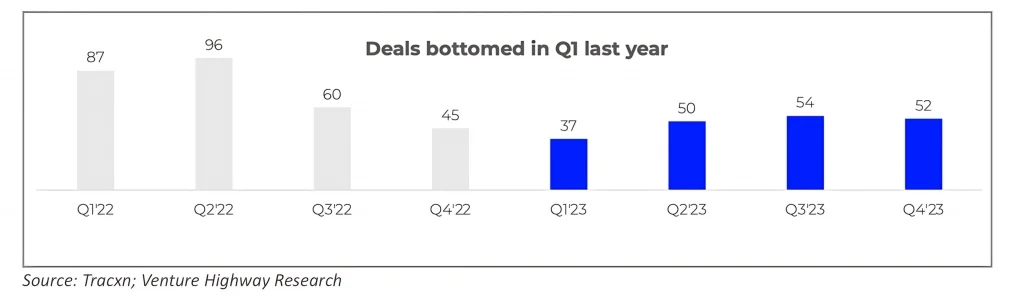

We also note that while the overall seed deal activity remained low in 2023 when compared to the year before, the market seems to have bottomed in the first quarter (JFM) of 2023 with a total of 37 deals during that period. The seed deal activity since then has recovered to over 50 seed deals/quarter; however it remains low compared to 90+ deals/quarter during the heydays of 2021 and early 2022.

Figure 2: Seed investment volume bottomed in Q1 2023

As table stakes mature, the blinds increase

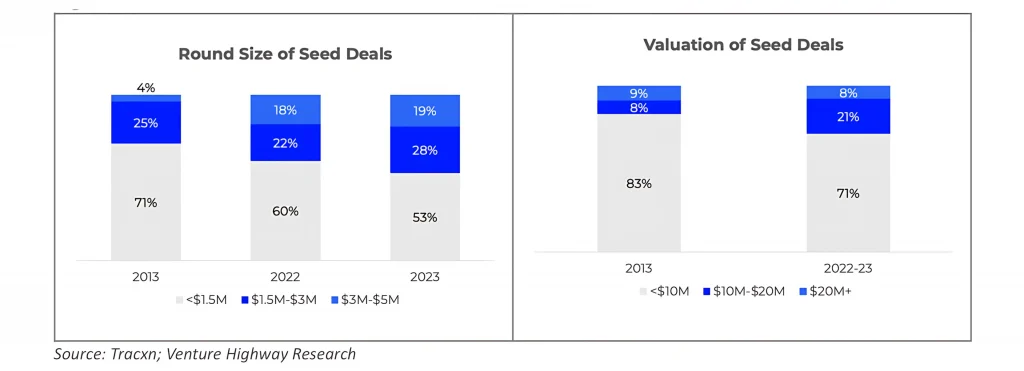

While investors may have re-calibrated their bar for pulling the trigger in the aftermath of the 2021 bubble, the ecosystem continues to have a lot of dry powder that was raised amidst the flood of liquidity in 2020-21. As a result, many seasoned investors as well as first time fund managers, particularly at the early stage, are sitting on a lot of cash eager to find promising investments. This, coupled with increasing confidence in India’s capability to create large outcomes, has led to a significant increase in the size of seed investments over the last decade.

Compared to c44 startups that raised more than $1.5M in their first early stage round in 2013, c92 startups raised rounds larger than $1.5M in 2023. The contribution of larger rounds in overall deal activity continued to increase over last year as well with c47% of total seed investments in 2023 being larger than $1.5M vs. c40% in 2022.

In our view, the increase in round size in 2023 over 2022, in spite of a weakening investment environment, can largely be attributed to large pools of capital chasing fewer high quality startups. It also highlights risk aversion in some sense as it can be argued that a lesser number of smaller rounds imply a lesser number of high-risk experimental and/or optionality checks.

While round size continued to inch higher, the entry valuations corrected to a more sober level with more than 70% of startups in 2022-23 raising their seed rounds at less than $10M post money valuation. However, when compared to a decade ago, the seed stage valuations have clearly ballooned – in 2013, almost 85% of the startups raised capital at less than $10M post and almost 70% raised at less than $5M post money valuation.

Figure 3: Seed valuations and round sizes in 2022-23 vs. 2013

Startups now come in all shapes and sizes

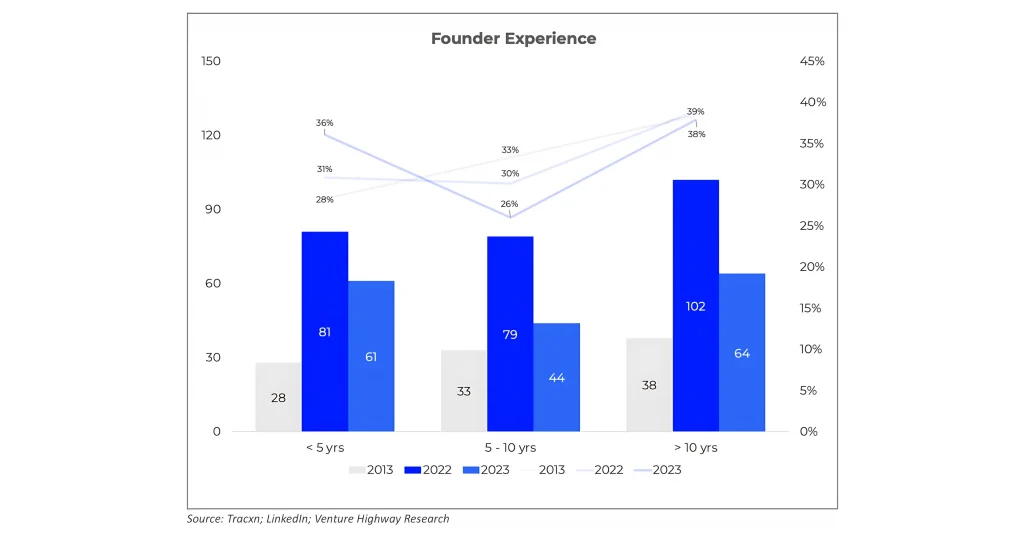

What was predominantly a consumption story a decade back, has now become a holistic narrative. Innovation has become a household phenomenon, and founders with all kinds of experience are now embracing this path.

Compared to 2013, when more than 70% of the funded founders had more than 10 years of experience, both 2022 & 2023 cohorts were a lot more evenly distributed amongst founders of varying experience, with experienced founders (>10 years exp) contributing just under 40% to overall seed deals. On the other hand, the representation of young founders (<5 years exp) amongst early stage investments increased to c36% in 2023 vs. c31% in 2022.

Figure 4: Change in founder mix in 2022-23 vs. 2013

As the number of entrepreneurs have almost exploded in the last decade, the canvas for innovation has also expanded significantly. We are not just a consumer internet phenomenon anymore and our startups are no longer a derivative of US business models. This has reflected in the diversity of the sectors which raised capital in 2022-23. While SaaS/AI and Consumer remained the largest sectors in terms of total deals, the contribution of other emergent sectors or frontier sectors also remained high. A significant number of deals happened in emerging markets like Space tech, Defence tech, Climate etc [bucketed under Others in the image below].

As the first generation of technology startups have matured and as public private partnership has evolved into a symbiotic relationship, we now see experienced operators, with shorter learning curves & deep business insights, increasingly starting new companies. The depth of talent pool in SaaS and FinTech has improved significantly over the last decade as operators from both incumbents & India’s big-techs are increasingly starting new companies. B2B commerce is also gaining traction with the consolidation of manufacturing, formalisation of 25%+ MSMEs and digitally-native next generation of traditional business owners taking charge.

On the other hand, we have seen a declining interest and deal activity in more saturated or turbulent sectors like Consumer Internet, Edtech and Health. We expect some of these categories will likely be re-imagined with the use of AI where we are seeing early applications in areas like radiology, customised learning modules and webtoons, amongst others.

Figure 5: Break up of seed investments across sectors in 2022-23 vs. 2013

The roots of innovation starting to run deep and wide

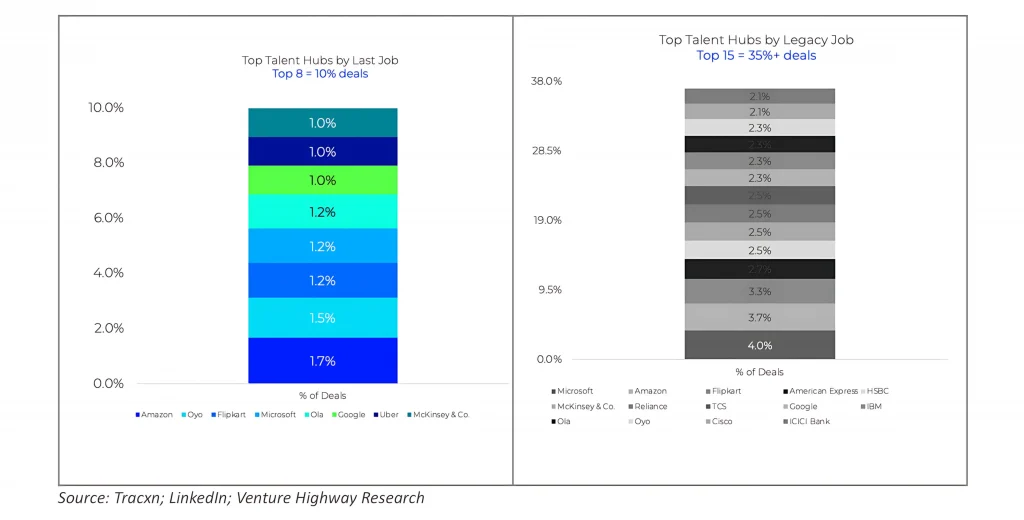

In the previous decade, large tech companies in India produced the highest number of funded startups in the country. More than 100 funded startups came out of Flipkart alone. However, the concentration of talent pools have started to reduce and in 2022-23, no single company produced more than 2% of funded startups. The top 8 companies (mostly tech behemoths like Flipkart, Amazon, Microsoft, Google, Oyo, Uber, etc) contributed only 10% of seed funded startups, as the last employer of the founders before starting up.

However, when we look at lifetime experience of founders, the top 15 companies contributed over 35% of the total seed funded startups in 2022-23. Interestingly, these companies not only include new economy tech giants but also old economy incumbents like Reliance, ICICI, TCS, Amex, HSBC, etc. This implies that the innovation is no longer just driven by the outsiders with disruptive perspectives but also industry insiders with deep domain expertise. The right to win is shifting from ‘sheer force of will’ to ‘unique insights’.

Figure 6: Genesis of startups in 2022-23 as per last job experience vs lifetime experience

Not just VCs, but Angels, Sharks & Dragons also seeding Unicorns

The make-up of risk capital has drastically changed in the last 5 years. What used to be a small friends & family round of a few ten thousand dollars to bootstrap product journey of a startup has now transformed into a professional seed / pre-seed round of several hundred thousand dollars. These new sets of investors, who typically invest much before VCs do, have many names – angels, sharks and dragons; but they have a similar characteristics: most of them provide what we call paying-it-forward capital – i.e. they are investing back into the ecosystem from which they earned their riches.

The flush of global liquidity & maturing of the tech ecosystem in India in the last 5 years has led to many IPOs, share buybacks, secondary exits and M&A – all leading to wealth in the hands of individuals who want to give back to the ecosystem. This has led to a sharp increase in super angels as well as micro VC funds who not only provide high risk capital but also help founders with advice & expertise, thus improving initial chances of success. This has been particularly pivotal to the growth of the startup ecosystem in the last 5 years and the spread of innovation across all kinds of products & services.

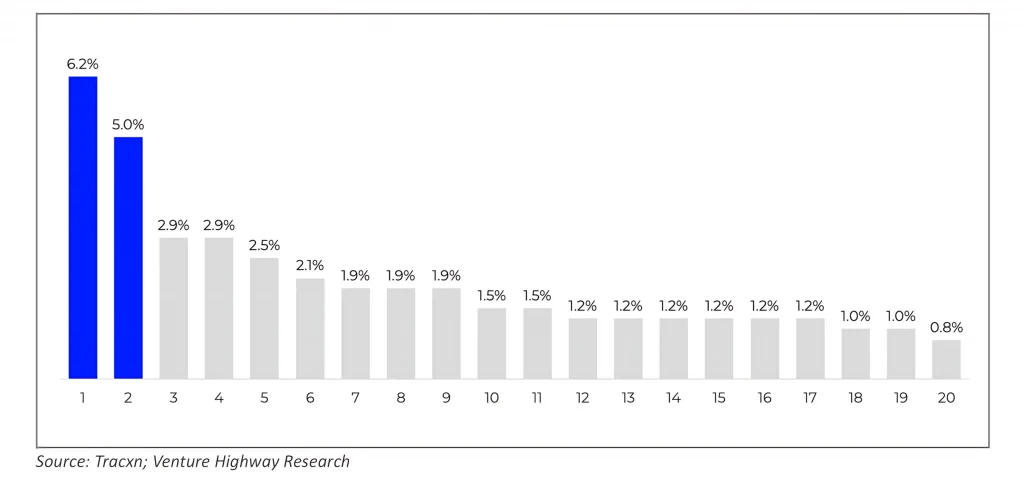

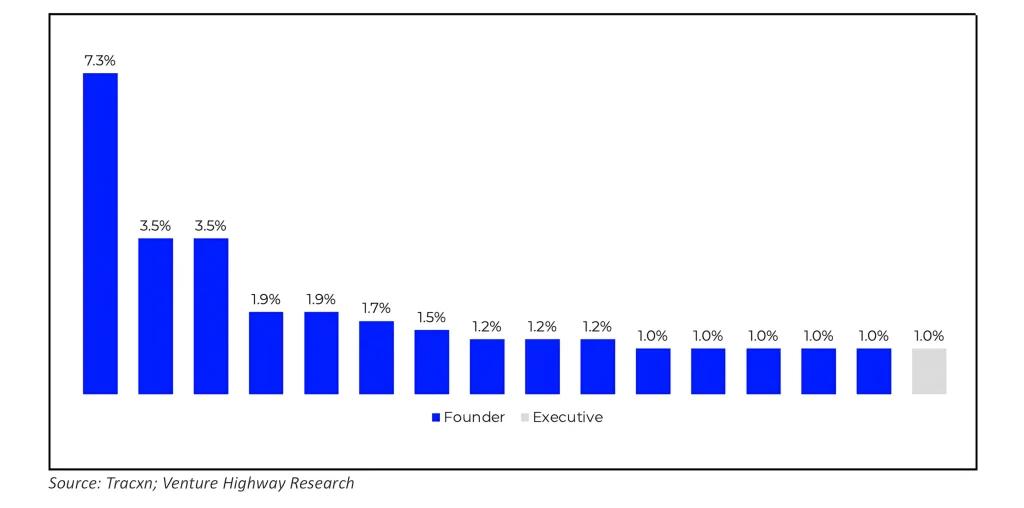

While there are more than 100 micro VCs in India today, top 20 micro VCs invested in more than 30% of all the seed investments that happened in 2022-23, making them one of the largest groups of investors. Similarly top 16 angels (out of 1,000s) invested in more than 20% of all the seed investments that happened in 2022-23. 15 out of these 16 angels are founders of successful startups who actively invest to pay it forward to the ecosystem.

Figure 7: Top 20 micro VCs participated in 141 or c30% of seed investments in 2022-23

Figure 8: Top 16 Angels participated in 103 or c20% of seed investments in 2022-23

It’s Day 1!

In traditional finance, people talk in terms of P&L, cashflow and balance sheet. A decade ago, while popular tech jargons like GMV, contribution margin, unit economics, retention, right to win, were common amongst a handful of VCs and tech entrepreneurs, they were not really mainstream in India by any stretch of imagination.

10 years later, thanks to Shark Tank, these jargons have become household knowledge. Entrepreneurship has become mainstream in India. CNBC could never do what Shark Tank has done – it has captured the imagination of the working class, and brought business & economics into every Indian households’ dinner table conversations, weaving the DNA of entrepreneurship into the social fabric of our country.

India’s startup story might be two decades old, but it’s still Day 1 for the entrepreneurs of this country, and this day is brighter than ever!