Seizing the Moment: Why Now is the Ideal Time to Build and Invest in Defense Tech in India

published By Siddhi Kasliwal , May 27, 2024

India’s push to become a global powerhouse across the geopolitical as well as economic axes comes with newer opportunities and challenges to be tackled through a steady balance of the public and private sector players. Defense is a critical area witnessing strategic shifts across the globe with the increased geopolitical conflicts. In the present day reality of multiple global conflicts, all countries are in the race to be at the cutting edge of innovation and be best equipped to showcase the most sophisticated defense mechanisms and ammunition against current or potential enemy entities.

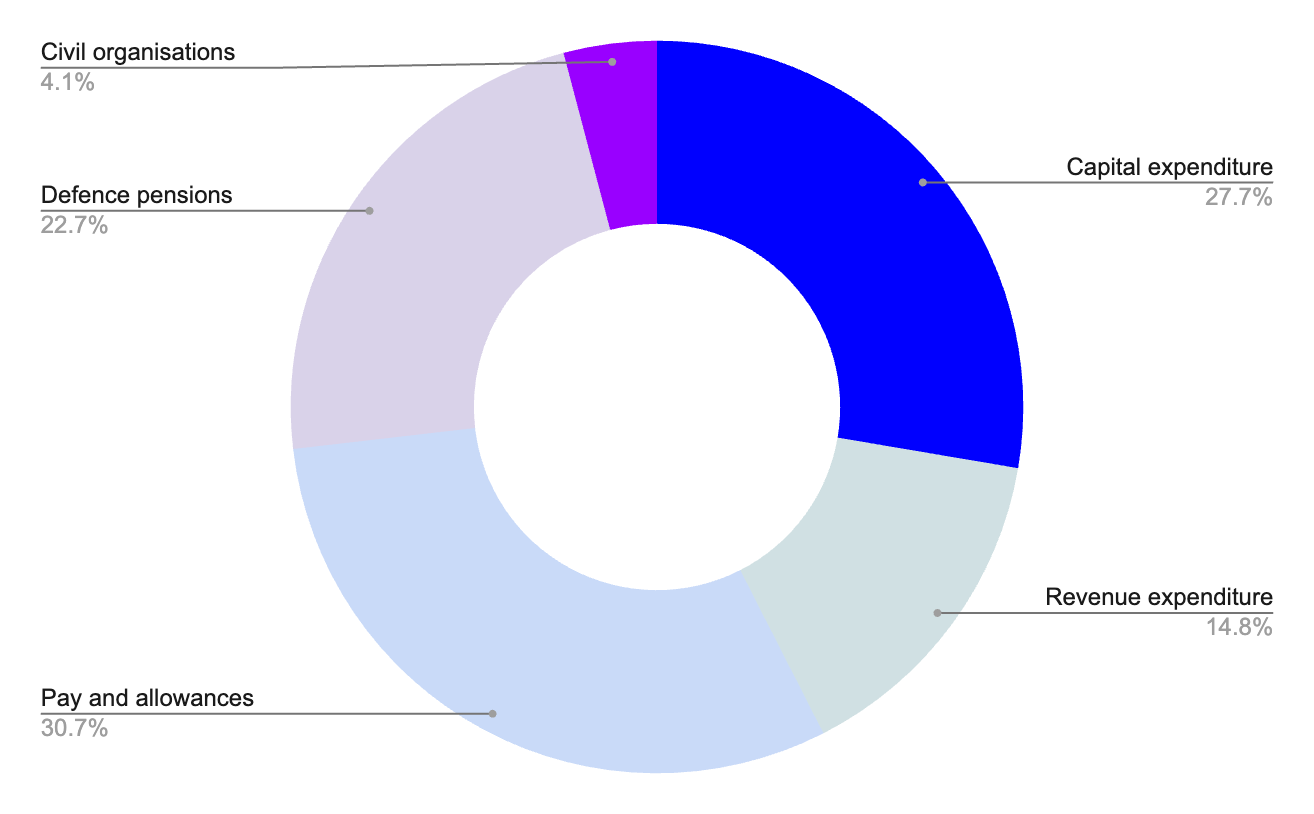

Defense is a sector one can’t ignore as an aspiring entrepreneur or as an investor owing to the size of the business opportunity, potential for disruption and the speed of innovation required. India’s total defense budget in 2024-25 is a whopping ~$75 Bn with over 27% of it to be utilized for capital expenditure (acquisition of new ammunition/equipment). The capital expenditure budget is open for all private players across all scales and sizes to demonstrate solutions for and cater to.

Following is the split of the defense budget of 2024-25:

Particularly in the 2024-25 budget, the certain key areas of focus within the budget have been about promoting innovation and protecting and strengthening the various entry points into the Indian territory/mainland. Border infrastructure has been allocated 30% higher budget than last year and the budget for coast guard has been higher than last year by 6.31%.

There is a $12Bn+ corpus for Deep Tech for long term loan to tech-savvy youth/companies and tax advantages given to the start-ups to give further impetus to innovation.

Defense, as a sector, isn’t new as there have been large PSUs and specialized companies building ammunition or components for it for a long long time now. However, India has historically been heavily dependent on multiple other countries like Israel, Russia, France and the USA for transfer of new age technology and ammunition, exposing our military capabilities to the global landscape entirely. To gain and hold strategic advantage, India can’t afford to be a laggard in defense and needs to develop indigenous technology and ammunition, now more than ever before.

Defence Acquisition Procedure 2020 has been a dramatic shift compared to the previous editions of the acquisition procedure. DAP 2020 lays out multiple strategic constructs and policies to accelerate innovation and boost the role of private players in the journey.

The key pillars within Defence Procurement and policies that are specifically of strategic importance to the private players and start-ups are: 1) Indigenisation and Innovation; 2) Supporting Infrastructure; 3) Exports in Defence – From India to the world

- Indigenisation and Innovation:

During 2020-25, the Department of Defence Production has set the target of indigenization of 5000 components.

The ministry also introduced a new category of procurement called Buy Indian-IDDM (Indigenously Designed, Developed and Manufactured). In any project, the companies developing design as well as manufacturing products get the highest priority for procurement.

The government has published 4 lists of positive indigenisation over the last 3-4 years and these will all be banned for imports in a phased manner by 2029, opening up opportunities for private players to supply strategically important components and products.

Frequently, these opportunities for import substitution are embraced by prominent Defense Public Sector Undertakings (DPSUs). Nonetheless, they often entrust product development and procurement to private enterprises to ensure adherence to strict timelines for component development and delivery. Moreover, in certain instances, innovative solutions for these import substitutes necessitate collaboration with research organizations and academia. The ripple effect of indigenization extends beyond major DPSUs supplying defense equipment, permeating the entire value chain and ecosystem encompassing defense research, development, and manufacturing.

To facilitate a seamless interface for industry participants in import substitution, an indigenisation portal called Srijan portal has also been launched. The portal currently showcases a list of around 36K items the DPSUs import typically and can be indigenised. Private players have an opportunity to cater to the demand of these items with the required specifications and substitute the imports.

The Defence Acquisition Procedure (DAP) 2020 includes “Make” categories designed to promote self-reliance by encouraging extensive participation from India’s industrial ecosystem, including the private sector, through the following constructs:

| Make-I | Make-II | Make-III | |

| Objective | Indigenous design and development with government funding support. | Indigenous design and development without government funding support. | Procurement of equipment already developed or commercially available. |

| Funding | Up to 70% of prototype development cost is funded by MoD, up to ₹250 crores per Development Agency (DA). | No government funding. Entirely industry-funded. | No government funding as products are commercially available. |

| Project Ownership | The Development Agency (DA) retains ownership. | The Development Agency (DA) retains ownership. | Developed by industry; procured by MoD. |

| Development Stage | Government-funded prototype development and trials. | Industry-funded prototype development and trials. | Focus on procurement of commercially available products with minimal customizations. |

| Examples | Future Infantry Combat Vehicle (FICV), Tactical Communication System (TCS). | Projects by MSMEs and startups for innovative defense solutions. | Procurement of standard commercial drones, communication systems. |

| Prototype Evaluation | MoD evaluates prototypes, provides feedback, and monitors progress. | Prototypes evaluated by MoD; feedback provided to developers. | Limited to assessing readiness and suitability for immediate deployment. |

| Timeframe | Typically longer due to extensive development and testing phases. | Moderate time frame depending on innovation complexity and development. | Shorter timeframe focusing on procurement and integration. |

In addition to the ‘Make’ procedures outlined, the Defence Innovation Organisation is a not-for-profit company registered to promote innovation fundamentally by bringing together multiple stakeholders in the ecosystem through a programme called iDeX.

iDeX – Innovation at the Intersection of ministry, startups and investors:

iDEX (Innovations for Defence Excellence) is a government initiative launched by the Ministry of Defence in 2018 to promote innovation and technological advancement in the defense and aerospace sectors. Its primary goal is to create a collaborative ecosystem involving startups, individual innovators, MSMEs (Micro, Small, and Medium Enterprises), research and development institutions, VCs and academia to develop cutting-edge technologies and solutions for India’s defense needs.

iDEX launches various challenges aimed at addressing the needs of the defense forces and Defense Public Sector Undertakings (DPSUs). Individual innovators and startups can submit their solutions to these challenges, which are then assessed by a selection committee. Successful proposals receive up to 50% of the necessary funds for prototype development, with amounts ranging from INR 1.5 crore to INR 25 crore. This funding facilitates the development of prototypes, which, upon approval, can lead to larger orders from the defense forces or DPSUs. The remaining 50% of the prototype development costs are typically sourced from incubators, VC funds, and grants from research institutions.

iDEX challenges are an excellent leading indicator of the verticals of growth and business to expect in the 5-10 years to follow as these are strategic areas of focus for the government.

- Supporting Infrastructure for Ease of Commercialisation:

Multiple new initiatives have been taken to accelerate and smoothen the path to commercialisation:

- Testing facilities of various government organizations like DRDO, DGQA and DPSUs have been opened up to private players to do seamless testing, allowing for quicker iterations and enhancing the probability of selection/success of the private players

- Third party inspection: The scheme aims to expedite the quality assurance process for defense equipment. Qualified third-party testing agencies are empanelled by the Directorate General of Quality Assurance (DGQA). Users, including the Army, Navy, Air Force, Ordnance Factory Board (OFB), Defense Public Sector Undertakings (DPSUs), Defence Research and Development Organisation (DRDO), and industry players, have the option to submit certain procured items to these agencies for testing.

- Exports in Defence – From India to the World:

India exported military hardware worth approximately $2 billion in the financial year 2022-23, marking its highest ever and representing a significant tenfold increase since 2016-17. India is exporting defense equipment to more than 85 countries now. Export authorisation has been made smooth and seamless through digital interventions. Defence Exim portal is an end to end platform where the exporters can register applications online and get digital and verifiable authorisations very quickly. Export leads received from Defence Attachés in various Indian missions abroad are shared online with exporters. In fact, for repeat orders, where the same items are exported to the same countries or entities, the TAT for authorisations is less than a day!

These developments have now made it possible for start-ups and private companies to envision a global go-to-market strategy and build from India to the world.

While product development and sales cycles in defense can involve high gestation periods, there have been some great examples of companies executing and delivering success stories as well as an exit for early backers through IPOs, strategic acquisitions and growth stage funding. IdeaForge is one of the foremost players that started building Unmanned Aerial Vehicles/Drones for defense as well as other applications, and had an IPO in 2023, 16 years post inception of the company. NewSpace Research and Technologies is another, one of the most highly funded startups in defense tech with the latest raise being a $52 Mn round in a mix of equity and debt. They are developing intelligent UAVs with a deep focus on R&D and new product development to always stay ahead of the curve on product capabilities. Another example of a successful outcome in defense tech is the electronics manufacturer named Alpha Design Technologies, which was acquired by Adani Defence.

With policy support in place and precedents of success in the sector, the current juncture presents a golden opportunity for embarking on a defense tech venture in India. By capitalizing on the amplified defense budgets and harnessing India’s strategic position in defense, nascent enterprises can not only make significant contributions but also foster growth. It’s a compelling moment to participate in shaping India’s defense technology sector, and those daring to seize the moment could chart its course for years to come.