Climate Finance: The Global Shift Towards Sustainable Energy

published By Akul Jindal , April 29, 2024

The Paris Agreement was adopted by 193 countries and EU in 2015 to “pursue efforts” to limit global temperature rises to 1.5C, and to keep them “well below” 2C above those recorded in pre-industrial times with each country setting its own emission-reduction targets, reviewed every five years to raise ambitions.

A key goal of the agreement was also for richer countries to help poorer nations by providing funding, known as climate finance, to adapt to climate change and switch to renewable energy, evidencing the need for large-scale investments for a phased, orderly transition.

Global Energy Transition Investment

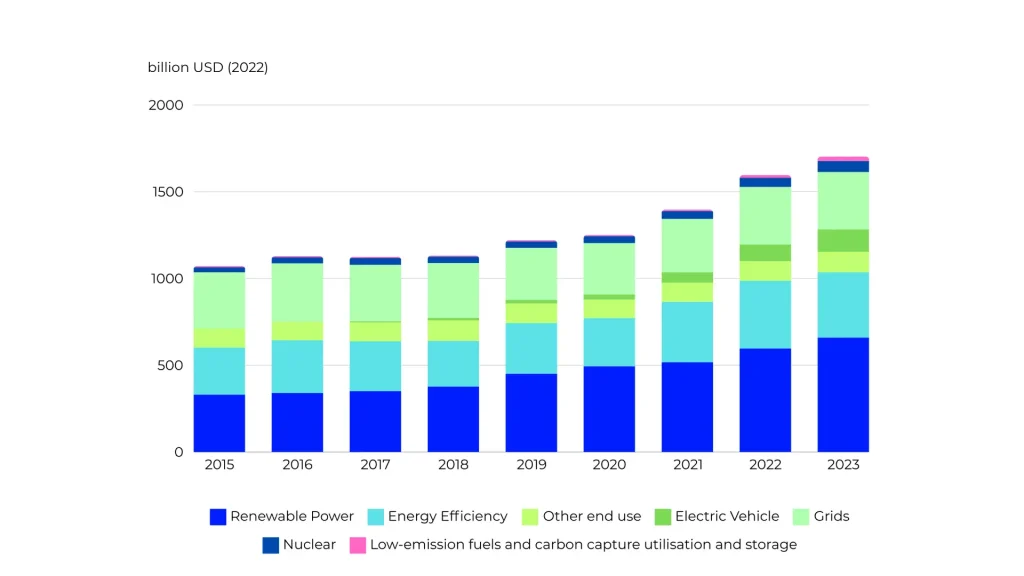

Since 2015, the world has invested more than $1T annually, in energy transition, reaching $1.75T in 2023. Our investment in renewable energy has doubled from c$330B in 2015 to $660B in 2023. A more interesting segment, however, which has 10Xed in 5 years, is electric vehicles, with investments growing from c$14B in 2018 to c$130B in 2023.

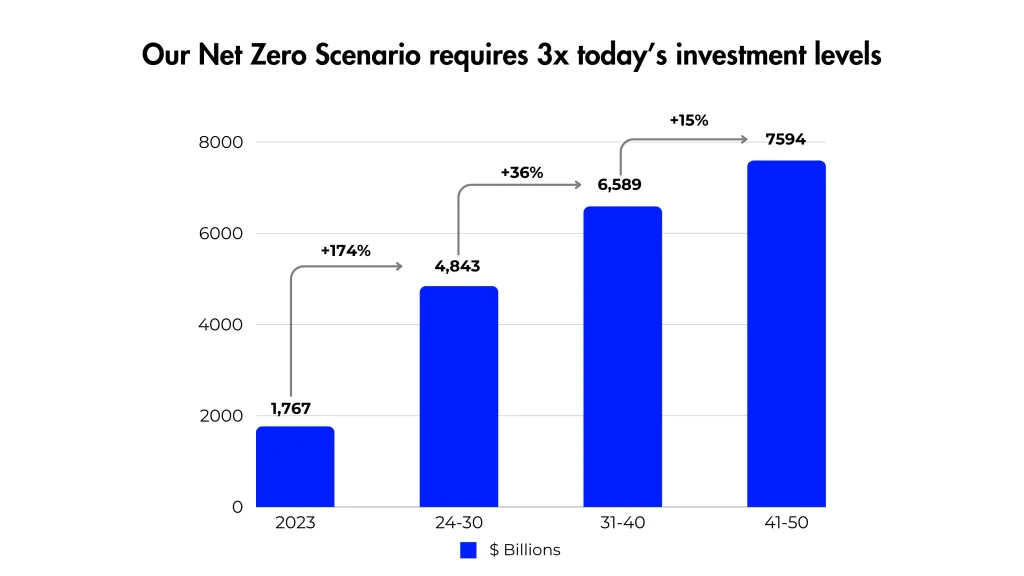

While the 75% growth over 8 years is promising, it is not enough. Estimates suggest that we need 3X the current scale of annualized investments over the next decade to reach our climate goals, with 2X more investments required in renewable energy and 3X more in electrified transport.

The Indian Scenario

Since 2020, the Indian government has consistently claimed to be on track to achieve the goals it set out in fulfilment of its obligation per the Paris agreement which included 4 lofty targets:

- India will increase its non-fossil-fuel energy capacity to 500 gigawatts (GW) by 2030.

- India will meet 50 percent of its energy requirements from renewable energy by 2030.

- India will reduce its total projected carbon emissions by 1 billion tons by 2030.

- By 2030, India will reduce the carbon intensity of its economy by 45 percent.

Estimates from IFC suggest that this will require investment upwards of $10T by 2070, for India to reach its “Net Zero” commitment.

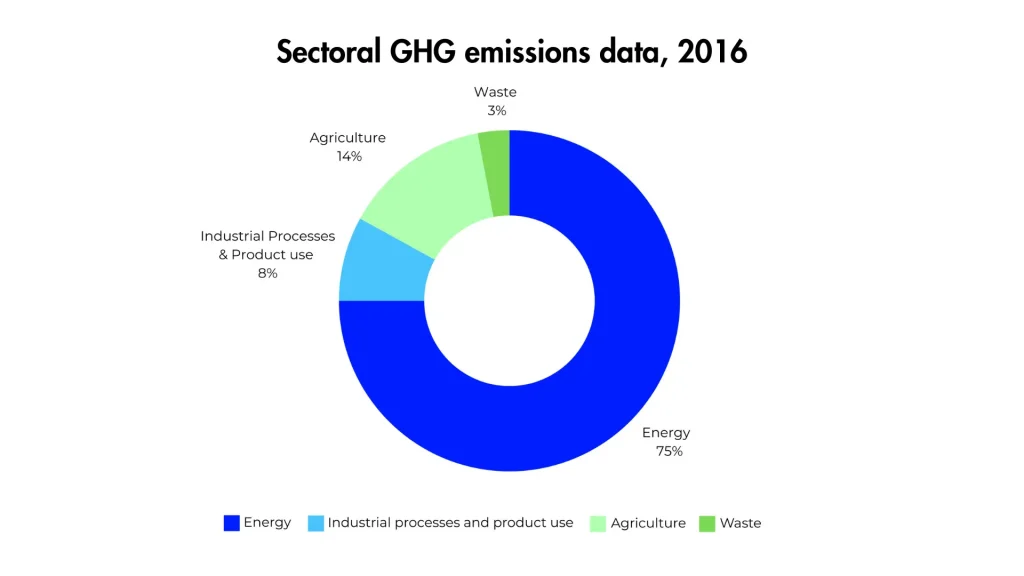

With 75% of India’s emissions originating from energy use, investments in the production of renewable energy and consumption via electrification of transportation are two critical segments that need significant capital investments.

Financing Energy Production: Rooftop Solar

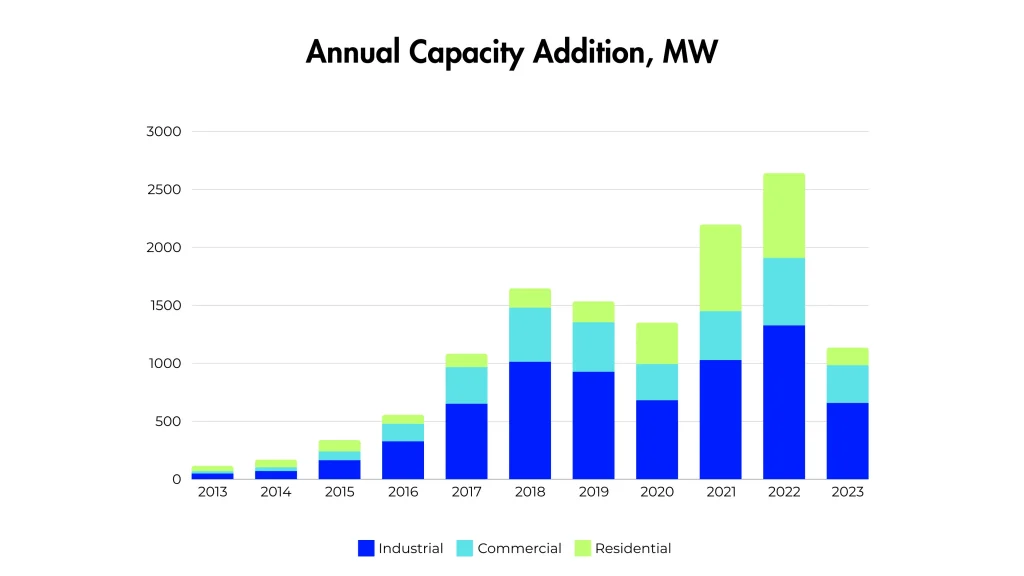

The Indian government has focused aggressively on rooftop solar, which generates 11 GW of electricity, with an ambitious target of 40 GW of electricity set for 2026.

Despite significant savings from a near-zero levelized cost of energy from solar and payback periods of under 5 years, the upfront installation cost remains prohibitively expensive for businesses and individuals alike. This has resulted in a slow uptake with the government having to push the initial 40 GW target to 4 years later.

A 3 kW set-up requiring 300 sq ft of rooftop space necessitates an expenditure of more than INR 1.2 lakhs. The payback period for a similar set-up at INR 6 per unit electricity cost is c4.5 yrs post which the the consumer only has to incur minimal maintenance charges for the setup.

Is financing not accessible for solar projects? Yes and no – while there is a strong push from the government, with low-cost finance made available by many banks and NBFCs through their schemes, access to such financing remains low.

The biggest barrier for MSME clients is a perceived lack of creditworthiness due to lack of credit information/ratings. This is further aggravated by the high transaction cost/time of MSME rooftop loans due to their small size, decreasing their attractiveness to lenders. Similar challenges combined with an inability to manage complex paperwork and understand structural requirements for rooftop solar compound the problem for retail consumers.

The principal argument against their poor creditworthiness for solar however is that electricity is a core raw material that MSMEs consume and have consistently paid for; a similar argument could be made for any retail consumer who would certainly undertake the installation of rooftop solar if the procurement and installation process could be simplified.

The opportunity for startups therefore lies in transforming this cash flow from an expense line item to a finance line item and in simplifying the complex process for both MSMEs and retail consumers.

The two models:

- Buy Now Pay Later (BNPL)

While the idea of BNPL traditionally brings to mind lifestyle purchases like apparel, accessories, electronics etc., BNPL for solar is a viable financial option that has been demonstrated with a reasonable degree of success.

Unlike other purchases that may not have a cash flow component, BNPL for solar allows the borrowers to get easy approval for solar financing leading to quicker installation, and converts the fixed upfront cost into easy monthly payments.

Companies like BrightE in Australia have disbursed $1B+ of 0-interest loans for the installation of solar power set-ups. Their customer cohort is typically individuals in their later ages, with good credit scores with the asset delivering a significant sustained value.

While there is no true 0-interest product, with the cost of financing baked into the product, and cash purchases producing upfront discounts, BrightE’s true value proposition lies in its ability to quickly disburse the required capital for solar installation through its partner vendors which solves your installation, financing and maintenance needs together.

- Offtake Agreements

These agreements have a very interesting characteristic: they do not alter the typical MSME behaviour of paying for electricity costs, but simply reduce your power bills.

In these models, the financier charges the consumer a pre-fixed rate of electricity per unit which is typically lower than their existing tariff, so the customer sees upfront benefits. The rate per unit is used to pay the negligible variable cost of solar energy production, then the interest on the loan, and lastly the principal on the loan.

Unlike the BNPL model, with a fixed monthly payment – the variable nature of the payments in offtake agreements which are contingent on electricity generated result in a wide range of IRRs which could range which could make management of cash flows a bit tricky for the financier but this model has the added benefit of negligible change in customer behaviour and easier customer education.

While startups may adopt either mode to deliver the financing required, a core requirement of both models, more than the interest charged, is the convenience they offer to both retail and MSME customers, making their decision to transition to solar energy easier and accelerating our transition to production of renewable energy.

Financing Energy Consumption: Electric Transportation

Road transport accounts for 12% of India’s energy-related CO2 emissions and is a key contributor to urban air pollution. To bring the emissions from this sector on track with the 2070 goal, the share of EV sales needs to reach 50% by 2030.

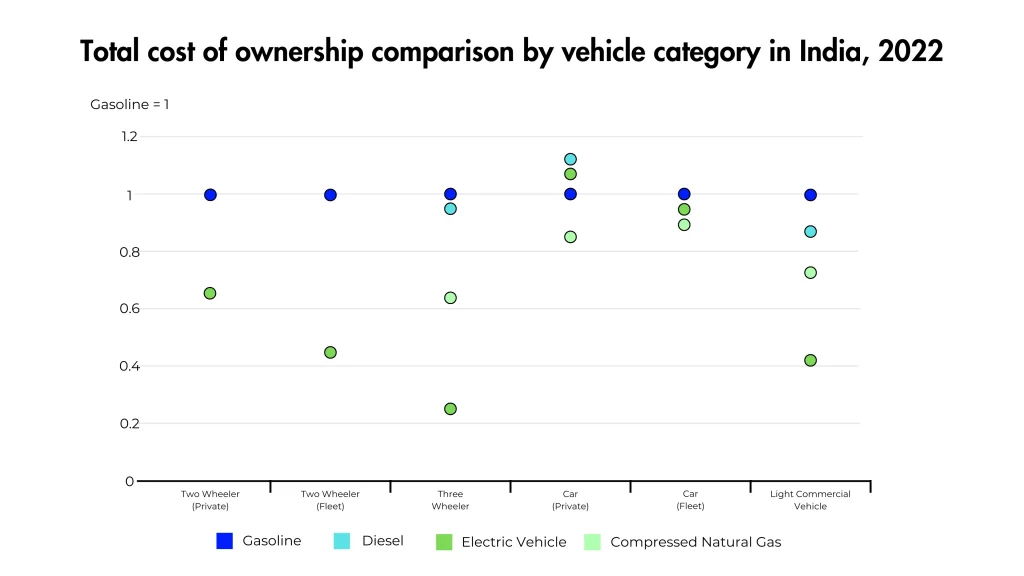

Green shoots of this transition are already visible with TCO for 2-wheeler, 3-wheeler and LCV categories for both personal and fleet use-cases being lower than ICE vehicles.

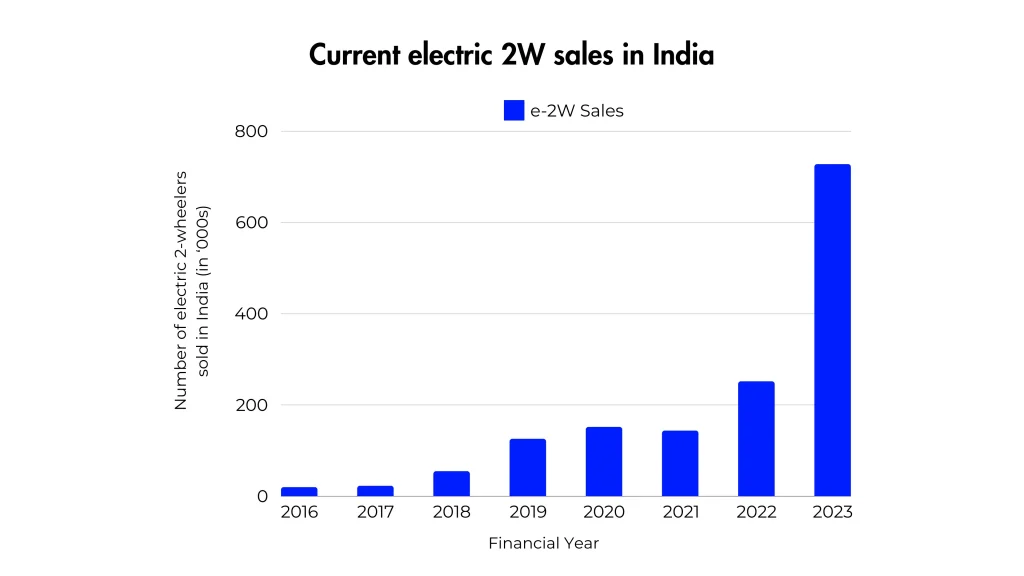

While the understanding of these benefits of owning 2-wheeler EVs has resulted in significant growth, with EVs already reaching 5% market share of sales in FY23…

… the EV ecosystem is still fraught with challenges.

The principal challenge for EV ownership remains an inability to underwrite the asset, emanating from a limited understanding of battery chemistry, and a non-existent/inactive secondary market for these assets.

For comparison, while on an ICE 2-wheeler, the loan-to-value ratio (LTV) can go as high as 95%, the comparable number for EVs is 80%. The tenor of the loan also ends up being lower, with the average tenor of 3 vs 4 years of EVs and ICE vehicles respectively. The interest rates on these loans also tend to be 1-4% higher.

While many Indian startups are attacking the problem from the problem statement of easier access to finance, and in some cases dealer-level financing to unlock benefits of portfolio diversification, in our view, true value for the segment will be unlocked with investments in the development of a secondary market for 2-wheeler EVs, which will provide assured returns for the assets, improving its residual value, reducing its risk profile for lenders and making it comparable to an ICE vehicle. Asset buyback programs and battery-repurposing schemes are other options that could help catalyze the creation of a secondary market for EVs.

An interesting development in the field is Piaggio’s 3-wheeler battery subscription model which de-links the battery purchase from the chassis, reducing the upfront purchase cost. While these models by themselves may be insufficient given the distribution and the massive scale of financing required, they could help catalyse the development of a financing ecosystem, much like the installation of the first charging stations were needed by OEMs to drive sales of EVs.

Closing Remarks

While we have only looked at two more prominent use cases, i.e. solar energy and EVs to illustrate our case for the requirement of easy financing across consumption and production of energy, our broader view is that in both cases and other climate finance opportunities, it is critical to look at ways and means of meaningfully improving the risk profile of the asset through creation or modification of cash flows to ensure that ample private capital can be mobilized to help us accelerate our transition to a more sustainable future.

If you are building in Climate Finance and wish to speak, please feel free to reach out to us at akul@venturehighway.vc