Beaker to Billions: The Rising Opportunity in India’s Specialty Chemicals

published By Abishek Chopra , Rahul Garg , April 22, 2024

In the grand laboratory that is the global market, India’s specialty chemicals sector stands out as a beaker bubbling with immense potential. Like a seasoned alchemist turning base metals into gold, India’s specialty chemicals sector is transforming raw materials into essential ingredients that power a plethora of industries worldwide.

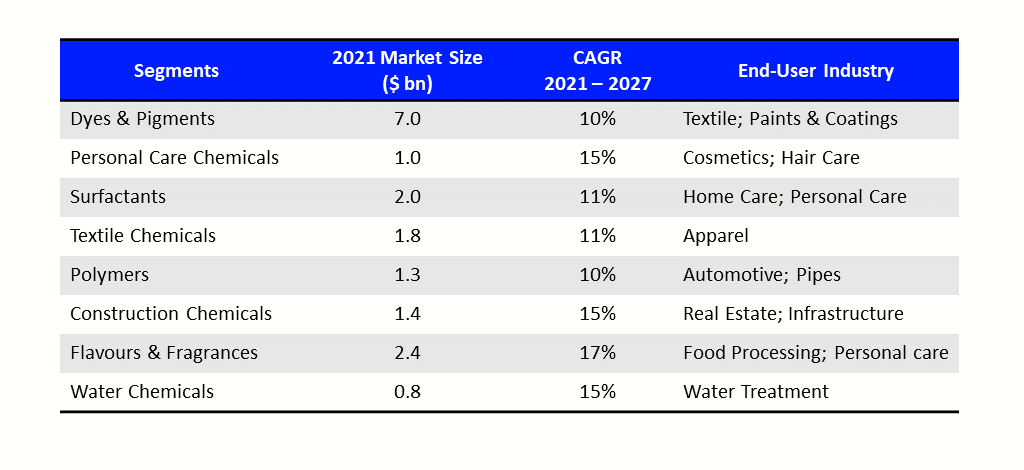

Specialty chemicals, by definition, are chemical products that provide a wide variety of effects on which many industries depend. From the vivid dyes that colour our fabrics/food to the advanced polymers that fortify our automobiles, these chemicals are the unsung heroes of our modern existence.

Table: Key Segments of Specialty chemicals in India and their end-use industry

With the overall increasing consumption across the nation and expansive industrial base (with more talent), India is becoming a large demand and supply hub, respectively. Additionally, with the technical know-how developed in the last decade, India is poised to become a global hub for new and pivotal compounds.

A large and compounding market awaits for entrepreneurs to tap

Globally, the chemical industry is a colossal market valued at approximately USD 4.7 trillion, within which India emerges as the fifth-largest chemical producer, marking its significance on the world stage. Despite its impressive position, India’s share in this vast global market is around 4.3%, in contrast to China’s 32%. The global chemical industry is predominantly made up of commodity chemicals, accounting for about 80% of the market, leaving specialty chemicals to fill the remaining 20%.

Zooming into India, the domestic chemical industry is worth a robust USD 200 billion, with specialty chemicals constituting about 18% of this and valued at approximately USD 36 billion. This segment of the industry highlights its potential for deeper penetration into global markets. Over the last five years, India’s chemical sector has experienced a strong compound annual growth rate (CAGR) of about 11.7%, indicating an expanding industry. The emergence of the Indian specialty chemicals market has been driven by the country’s strong process engineering capabilities, low-cost manufacturing capabilities, and abundant manpower.

Image: Country-wise Chemical market size; India Chemicals split

This segment is forecasted to continue its upward trajectory with an expected 12.4% CAGR, reaching an estimated USD 64 billion by the calendar year 2025. This anticipated growth underscores India’s increasing importance and evolving role within the global specialty chemicals market, setting the stage for increased contribution to the global chemical industry

The specialty chemicals sector, in particular, is poised for remarkable growth, driven by a combination of factors including increased demand in domestic and international markets, advancements in chemical technology, and a strategic shift towards high-value chemicals. Let’s explore these further!

Strong macro tailwinds catalyzing India’s specialty chemicals sector

- Focus Shifting away from China : Amidst rising geopolitical tensions and stringent safety regulations imposed by the Chinese government, the global supply chain for raw materials in the chemical sector has faced disruptions. This has led to an increase in the prices of certain specialty chemicals, compelling the industry to look beyond China for sourcing these crucial inputs

- Growth in R&D and Process Engineering capability in India : Historically, India has had a big gap in technical expertise necessary for the complex production processes of specialty chemicals. In recent years, there has been a significant improvement in R&D capabilities and process engineering know-how. This evolution places India at the forefront of innovation in the specialty chemicals sector. Given the complexity of Specialty chemicals’ elements, technical know-how is critical.

- Government catalyzers : Measures such as anti-dumping duties on Chinese imports, public procurement policies favoring domestic producers, tax subsidies, simplified regulations, and export promotion schemes have all acted as accelerators for the industry’s growth.

- Rise in global demand driven by rise in rise in end-user categories : Growth in the end-user industries, such as pharmaceuticals, food, construction, electronics, and dyes/pigments, has led to stronger sustainable demand & growth for specialty chemicals.

- Low per capita consumption across product categories : Current per capita consumption of chemical products in India is about one-tenth the world average, indicating huge headroom for growth.

While there is clear room for more specialty chemical manufacturers, we believe specialty chemicals also present a unique opportunity for a managed B2B marketplace due to certain gaps in the supply chain. Some of the gaps include :

- Fragmented Supply, Making the Discovery Challenge : Specialty chemicals are complex and proprietary formulations and functional agents responsible for critical features of the end products. Specialty chemical manufacturers specialize in specific ingredients and processes, leading to a highly fragmented supply. There are a total of 100K+ SKUs across various manufacturers in India.

- Fragmented Distributors, each having limited SKUs : The range of SKUs with distributors is limited given their limited know-how/expertise in a few chemicals/categories. Hence, the distributors in the space are also fragmented. For example, Europe has 20K+ small distributors, with the top 5 distributors accounting for less than 15% of the market. India is even more unorganized.

- Lack of innovation-first distributors : End product manufacturers like to work with distributors to take specialty chemicals from multiple suppliers and create formulations specific to the need of the new products that they may be launching. This could provide innovation-led moat.

- Fragmented Supply Chain leading to longer lead times : End product manufacturers often procure Specialty chemicals in small quantities as they are typically <20% of end product composition. Hence, it is hard for them to identify & procure directly from small & fragmented manufacturers and hence, a product moves across 3 – 5 stakeholders, leading to longer lead times and potential for losses in transit.

- Sub-Par Warehousing and Fulfilment of Specialty chemicals : Specific packaging and vehicles are needed to ensure quality retention and low oxidation losses. Currently, there is limited.

- Lack of QA, Order Tracking and Poor Documentation : QA is very critical given the criticality of specialty chemicals in the end product. However, QA is time-consuming and hence, many distributors skip this. Additionally, there is no order tracking, visibility and trail in terms of fulfilment & documentation.

Global precedents and insights: Azelis and IMCD model a winning playbook for specialty chemicals B2B marketplaces

There are two large global companies – Azelis & IMCD, both European and are currently at GMV of c.$5B each. The growth has been a combination of organic growth & bolt-on acquisitions (much like ofBusiness in India, which has made 50+ small acquisitions). Both companies operate across all categories & have built both private labels as well as in-house formulation labs to drive value add over & above aggregation. This is a core playbook in this sector, and we believe it will play out similarly in India.

These companies also exhibit impressive financial performance with high operational efficiencies, highlighted by:

- 25% gross margins

- 11-12% EBITDA margins

- 8+ inventory turns => high RoCE of 40%+

- Net working capital of 40-50 days

Such metrics underscore their robust business models in the B2B marketplace for specialty chemicals.

Identifying this opportunity, we have seen a few companies in India who are building a managed B2B marketplace for specialty chemicals in the last few years.

Table: Illustrative list of B2B Specialty Chemicals companies in India

As India’s specialty chemicals sector expands, driven by robust demand, technical prowess, and strategic global shifts, the future radiates with potential. This landscape presents a strong opportunity for managed B2B marketplaces, poised to streamline the fragmented supply chains and catalyze innovation. By embracing models pioneered by global leaders like Azelis and IMCD, and fostering a dynamic ecosystem of collaboration and innovation, India can significantly elevate its role in the global chemicals industry, turning challenges into scalable opportunities.